DSCR Loans Explained: No-Income Verification for Investment Properties

DSCR Loans: How Real Estate Investors Are Qualifying Without Tax Returns

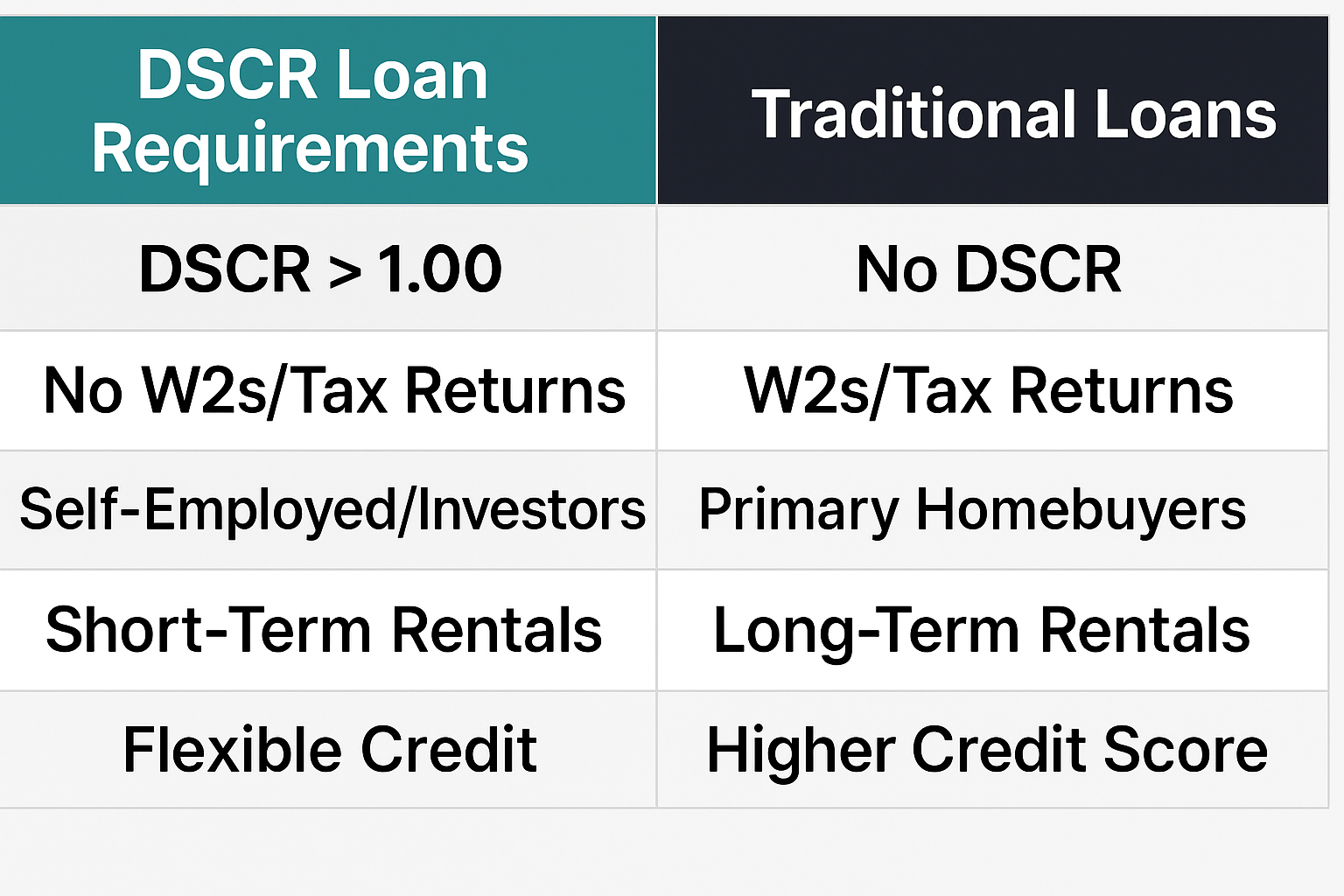

If you’ve ever dreamed of owning rental properties but got stuck on the traditional mortgage requirements—like showing tax returns, W2s, or pay stubs—DSCR loans could be your golden ticket.

Whether you're a full-time investor or just starting out, Debt Service Coverage Ratio (DSCR) loans open the door to real estate without the red tape of income verification. Let’s dive into what DSCR loans are, why they’re such a game-changer, and how Mortgage to Invest can help you qualify today.

What Is a DSCR Loan and How Does It Work?

A DSCR loan is a type of mortgage designed specifically for real estate investors. Instead of verifying your personal income, lenders look at the property’s rental income to decide if you qualify.

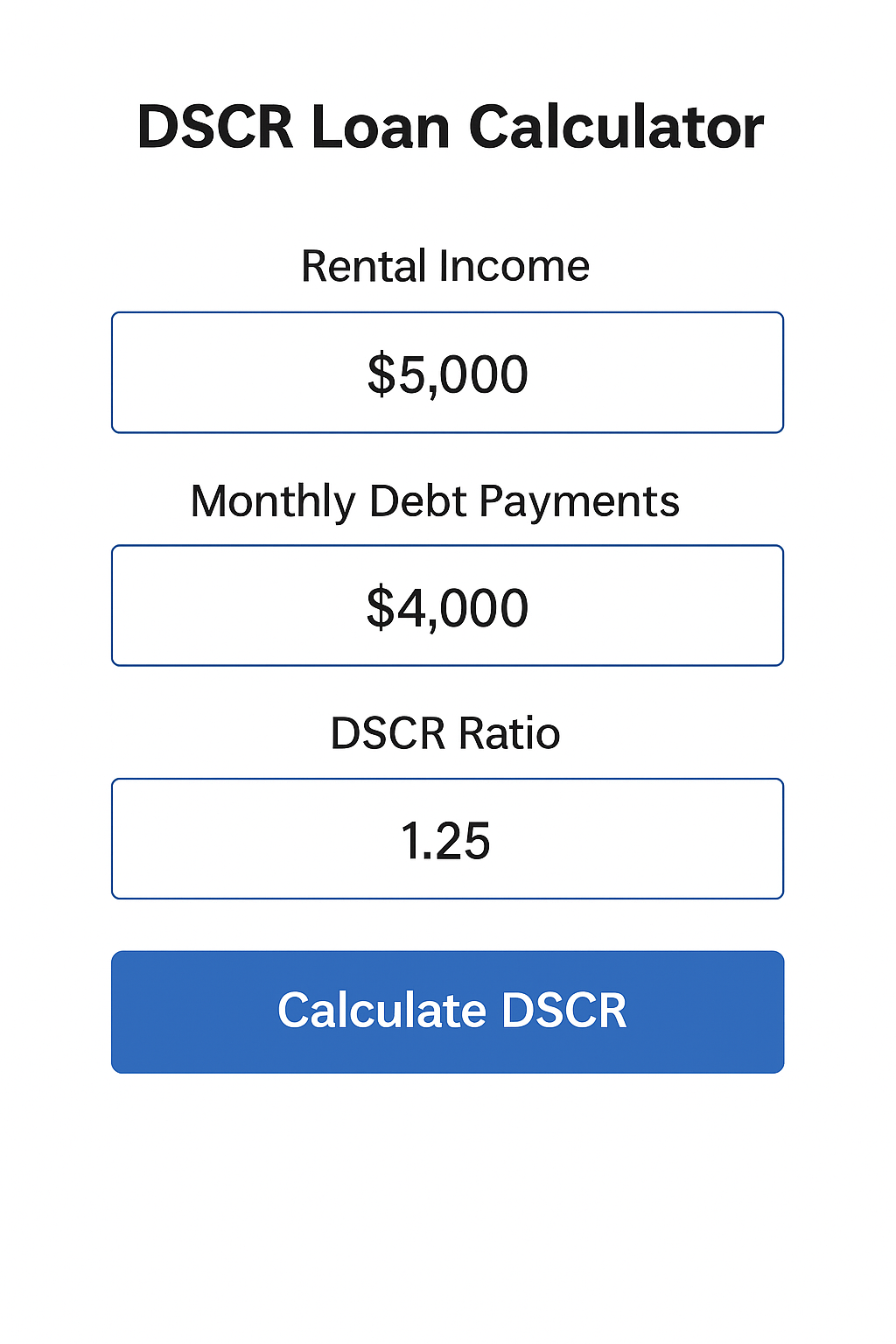

Your DSCR is calculated like this:

DSCR = Gross Monthly Rent / Monthly Mortgage Payment (PITI)

If your DSCR is 1.0 or higher, it means the property can cover its expenses—and you may qualify for financing even if your tax returns show little or no income.

This makes DSCR loans ideal for:

Self-employed investors

1099 contractors

Foreign nationals

Retirees with rental portfolios

Anyone who reinvests profits and shows low personal income

✅ Real value: You don’t need to prove your job income—just that the property pays for itself.

Why DSCR Loans Are a Game-Changer for Investors

Let’s be real: Traditional lenders often kill deals. You could own five profitable rentals and still get declined because your personal income doesn’t “look right on paper.”

With a DSCR loan, the property is the asset, not you.

Here’s why smart investors are using DSCR loans:

No tax returns or W2s required

Close in an LLC or your personal name

Perfect for long-term or short-term rentals (Airbnb/VRBO)

Fast closings—often 2-3 weeks

Minimal documentation

Some DSCR lenders even allow interest-only options, so your monthly payments stay low while your cash flow grows.

What Is a Good DSCR Ratio?

Most lenders want to see a DSCR of 1.0 or higher, meaning the rent covers the mortgage payment. Some prefer 1.1–1.25 for more cushion, while others allow as low as 0.75 if you have strong reserves or experience.

Here’s a quick breakdown:

DSCR Value What It Means Below 1.0 Negative cash flow 1.0 Break-even 1.1+ Positive cash flow (preferred)

🏠 Example:

Rent = $2,000/month

Mortgage (PITI) = $1,600/month

DSCR = 2,000 / 1,600 = 1.25

That’s a strong ratio, and you'd likely get approved quickly.

What Kind of Properties Can You Buy with a DSCR Loan?

DSCR loans are incredibly flexible, letting you finance:

Single-family rentals

Duplexes, triplexes, and fourplexes

Condos and townhomes

Short-term rentals (Airbnb/STR-friendly lenders)

Some mixed-use properties

You can buy as many properties as you want—no limit on financed properties like conventional lenders.

At Mortgage to Invest, we’ve helped clients finance everything from their first rental to entire portfolios across the U.S.

How to Qualify for a DSCR Loan

While these loans are flexible, here’s what most lenders will look for:

Minimum credit score: 620–680+

Down payment: 20–25%

Property cash flow: DSCR ≥ 1.0 (or close)

Reserves: 3–12 months of PITI, depending on the lender

✅ Good to know: Many DSCR loans are non-QM loans, which means they don’t follow Fannie Mae/Freddie Mac guidelines. This allows more flexibility—but also means terms and rates vary widely.

DSCR Loan Rates: What to Expect

Rates for DSCR loans tend to be 1–2% higher than traditional loans. But don’t let that scare you. These loans are designed for cash-flowing assets, so the return usually outweighs the rate.

Rates can also vary based on:

Your credit score

Loan-to-value (LTV) ratio

Type of property

Short-term vs. long-term rental use

📊 Pro Tip: Use a DSCR loan calculator to estimate your loan terms before applying.

Common DSCR Loan Myths (And the Truth)

Let’s clear up a few common myths about DSCR loans:

❌ Myth 1: You need high credit to qualify

✅ Truth: Many lenders accept credit scores as low as 620

❌ Myth 2: Only long-term rentals are allowed

✅ Truth: Many DSCR lenders allow short-term rentals like Airbnb

❌ Myth 3: DSCR loans are only for experienced investors

✅ Truth: New investors with strong deals can still qualify

Don’t disqualify yourself—talk to a specialist first.

Why Work with me, Orlando Concepcion?

I specialize in DSCR loans and work as a direct lender with Jet Direct Mortgage, giving me access to over 100 flexible mortgage programs tailored for real estate investors. If your scenario doesn’t align with our in-house options, I can also broker your loan through one of my trusted, out-of-the-box lending partners—so you always have a path forward, no matter how unique your situation.

Here’s what you get with us:

Fast approvals and closings

No fluff—just real investor insight

Personal guidance from experts who invest, too

Flexible underwriting for LLCs and unique scenarios

Transparent fees and personalized terms

I am not just a loan officer— I am your investment partner.

Licensed in multiple states, and available nationwide.

Want to Learn More? Check Out These Related Posts:

Bank Statement Loans: Qualify Without Tax Returns or W2s (Coming Soon)

The Best Mortgage Options for 1099 and Self-Employed Borrowers (Coming Soon)

For more insight into DSCR strategies, see this Investopedia guide on DSCR.

FAQs About DSCR Loans

Q: Can I use rental projections instead of a lease?

A: Yes, especially for short-term rentals. Some lenders use AirDNA or market rent estimates.

Q: Can I refinance with a DSCR loan?

A: Absolutely. DSCR loans are available for cash-out refinances and rate-term refinances.

Q: Can I close in an LLC?

A: Yes, many DSCR lenders allow or prefer you to close in your LLC or business name.

DSCR Loans Make Investing Easier Than Ever

In today’s market, flexibility is everything—and DSCR loans give you just that. Whether you’re building your first rental or scaling your portfolio, this type of financing lets the numbers do the talking.

📞 Let’s Talk: Call us at 619-586-9597

🌐 Visit: www.mortgagetoinvest.com

📧 Email: [email protected]

Let’s get you approved and cash-flowing!

Key Takeaways

DSCR loans let you qualify based on the property’s income, not yours.

You don’t need tax returns, W2s, or pay stubs.

These loans are perfect for real estate investors—new or experienced.

They work for short-term and long-term rental properties.

You can close in your LLC and scale your portfolio fast.