Flexible Mortgage Solutions for Real Estate Investors and Self Employed Borrowers

Specializing in DSCR and Non-QM Loans Tailored to Your Needs

DSCR Investment Loan Program

Use rental income to qualify — no tax returns or W2s required. Ideal for real estate investors.

Bank Statement Loan Program

Use 12–24 months of bank deposits to qualify — no tax returns needed. Great for self-employed borrowers.

Profit & Loss Loan Program

Qualify using a CPA / PTIN Tax preparer-prepared Profit & Loss statement — no tax returns required. Great for business owners with non-traditional income.

Frequently Asked Questions:

What is a Non-QM loan?

A Non-QM (Non-Qualified Mortgage) loan is a loan that doesn't meet the standard requirements of agency guidelines (like Fannie Mae or FHA). They’re designed for borrowers who may not qualify for traditional financing but can demonstrate ability to repay in other ways.

Who are Non-QM loans good for?

Self-employed borrowers Real estate investors, Foreign nationals, High net worth individuals but low income on paper

What is a DSCR loan?

A DSCR loan is for real estate investors and is underwritten primarily using the income from the investment property—not personal income.

How is DSCR calculated?

DSCR = Gross Monthly Rent ÷ PITIA (Principal, Interest, Taxes, Insurance, and HOA if applicable). Example: $2,000 rent ÷ $1,600 PITIA = 1.25 DSCR

What’s the minimum DSCR needed to qualify?

Usually 1.00 (property breaks even), though some outlets go down to 0.75 with adjusted pricing .

Are personal income or tax returns required?

No. DSCR loans do not require personal income documentation.

Can short-term rental income (Airbnb) be used?

Yes, some outlets accept it, often with documentation like Airbnb reports or bank deposits. Policies vary.

Who are bank statement loans designed for?

Primarily self-employed borrowers who write off expenses on tax returns and need alternative income documentation.

How is income calculated?

Lenders average 12 or 24 months of business or personal bank statements. Deposits are analyzed to determine income.

Do I need a CPA or Tax preparer letter?

Yes, many lenders require a CPA or tax preparer with a PTIN (Paid Preparer Tax Identification Number) to provide a letter confirming the borrower’s self-employed status and, in some cases, the business expense ratio.

How are business expenses handled?

Lenders typically apply a standard expense factor (e.g., 50% or 20%) to the borrower’s income, but this can vary. Some lenders may accept a more precise business expense ratio if provided by a CPA or tax preparer.

What kind of bank statements are acceptable for a bank statement loan?

Lenders typically accept either business or personal bank statements to document income, depending on the structure of the borrower’s self-employment.

What is a P&L loan?

A P&L loan is a type of Non-QM mortgage designed for self-employed borrowers whose income is calculated using a Profit & Loss (P&L) statement instead of traditional tax returns. This approach allows borrowers to qualify based on actual business performance rather than taxable income, which may be reduced due to write-offs. The P&L must cover either: The most recent 12 months, or the most recent 24 months, and must extend through the most recent full month.

Do I need to show bank statements too?

Yes. Most lenders require 2–3 months of recent business bank statements to validate the income shown on the P&L and confirm consistent cash flow.

Who can prepare the P&L?

The P&L can be prepared by a CPA or a tax preparer with a valid PTIN (Paid Preparer Tax Identification Number).

⭐️⭐️⭐️⭐️⭐️

“Got approved without showing my tax returns.”

I’m self-employed and had been turned down by two banks. Orlando got me qualified using my bank statements and closed fast. Highly recommend for any investor needing a flexible mortgage solution.

Jorge N., Houston, TX

⭐️⭐️⭐️⭐️⭐️

“Finally someone who understands real estate investors.”

The DSCR loan Orlando arranged helped me close on a duplex with no income verification. The process was simple, and he explained everything clearly. I’m already planning my next investment with him.

Carlos T., Tampa, FL

⭐️⭐️⭐️⭐️⭐️

“Stress-free and efficient from start to finish.”

I used a P&L loan because I have complex business income. Orlando’s team worked with my CPA and got it done quickly. No tax return drama — just results.

Michelle D., Scottsdale, AZ

Rapid Rescore: How Can It Help You Buy a Home Faster?

This process helps update your credit report quickly to help you qualify for loans like DSCR, Bank Statement, or Profit and Loss. Find out how a rapid rescore can speed up your journey to homeownershi... ...more

Investor Financing Strategies ,Self Employed Mortgage Programs

July 03, 2025•7 min read

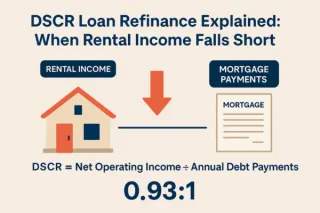

Beating the DSCR Shortfall: How I Secured 75% LTV for My Client

A smart adjustment that helped my client with a cash-out refinance on an existing rental property. It represented a successful strategy to improve DSCR from 0.93 to 1.0. ...more

Investor Financing Strategies

June 20, 2025•3 min read

Rejected by the Bank Again?

Self-employed and denied a mortgage? Discover how bank statement loans are helping entrepreneurs, freelancers, and investors finally qualify—no tax returns needed. A smarter solution for non-tradition... ...more

Self Employed Mortgage Programs

June 17, 2025•4 min read

Why Moving Fast with a Higher Interest Rate Can Be Smarter Than Waiting for a Better Deal

Discover why acting fast—even with a high-interest loan—can lead to major real estate gains. Learn how Non-QM and hard money loans helped one investor secure a $1.2M property for $600K. Speed matters ... ...more

Investor Financing Strategies

May 26, 2025•3 min read

What Are Non-QM Mortgages and How Do They Work?

Struggling to qualify for a traditional mortgage? Discover how Non-QM loans offer flexible solutions for self-employed borrowers and investors. Learn how you can finally buy the home of your dreams—no... ...more

Investor Financing Strategies ,Self Employed Mortgage Programs

May 22, 2025•3 min read

DSCR Loans Explained: No-Income Verification for Investment Properties

Learn how DSCR loans work and why they’re ideal for real estate investors. No income verification, fast approvals, and flexible terms — perfect for building your rental portfolio. ...more

Investor Financing Strategies

May 21, 2025•5 min read

This website is owned and maintained by Orlando Concepcion, a licensed Mortgage Loan Originator NMLS ID: 2303331 affiliated with Jet Direct Mortgage. The information provided is for educational and informational purposes only and does not constitute a mortgage application, loan offer, or official advice. This site is not affiliated with Jet Direct Mortgage and is intended solely as a personal platform to help consumers better understand real estate investing and Non-QM mortgage solutions such as DSCR, bank statement, and profit & loss loans. If you would like to apply for a mortgage or speak with Orlando in his official capacity as a licensed loan originator, please visit: https://jetdirectmortgage.com/orlando/