Beating the DSCR Shortfall: How I Secured 75% LTV for My Client

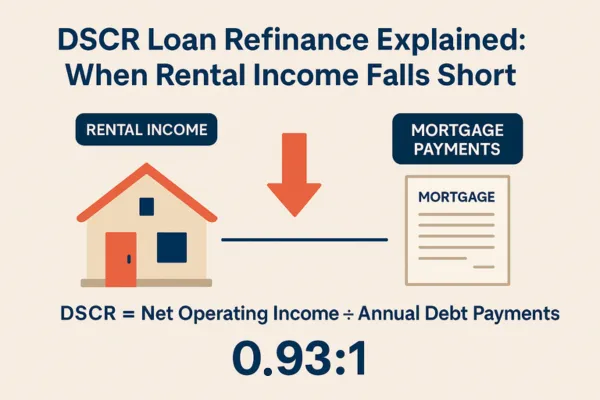

Ever had a DSCR loan refinance almost fall apart because the rental income didn’t quite cover the mortgage? That’s what happened when I helped a client with a cash-out refinance on an existing rental property—only to discover the DSCR came in at 0.93:1.

With a lender requiring a minimum DSCR of 1.0:1, it looked like we might have to drop the Loan-to-Value (LTV) from 75% to 70%. But with a smart adjustment, I helped the client meet the minimum and lock in the full 75% LTV.

Here’s how we pulled it off.

What is a DSCR Loan and How It Impacts Cash-Out Refinances

A DSCR loan helps investment property owners qualify based on the property’s cash flow, not personal income. The Debt-Service Coverage Ratio (DSCR) tells lenders whether your property generates enough income to cover its mortgage.

DSCR = Net Operating Income / Annual Debt Payments

Most lenders require a DSCR of at least 1.0, meaning rental income must fully cover mortgage costs.

If your DSCR is under 1.0, even slightly, lenders often lower the loan amount. That’s where this deal nearly went sideways.

Case Study: How We Turned a DSCR of 0.93 Into a 75% LTV Approval

The Problem: DSCR Was Just Below the Threshold

My client was doing a DSCR cash-out refinance on a rental property they already owned. The plan was to extract equity at 75% LTV for reinvestment.

But the underwriter calculated the DSCR at 0.93:1, falling short of the required 1.0:1 minimum.

The Solution: Improve Cash Flow to Meet DSCR

Rather than accept a lower LTV, I restructured the deal with a strategic lever:

We extended the prepayment penalty by 12 months

That allowed the lender to offer a lower interest rate

The rate drop improved monthly cash flow, raising the DSCR to 1.0:1

That small adjustment made all the difference. The underwriter approved the full 75% LTV, and my client, like in other cases I've been working, walked away with a better rate and full access to their equity.

Why Prepay Penalties Can Be a DSCR Lifesaver

Many investors view prepay penalties as a limitation—but they’re often a powerful tool. By extending the penalty term:

You can negotiate a lower mortgage rate

That improves cash flow

Which boosts DSCR—possibly enough to save the deal

In this case, that’s exactly how we went from 0.93 to 1.0—and saved the 75% LTV.

How to Structure a DSCR Loan to Hit Your Numbers

Verify Rental Income Carefully

Use current leases

Run Pre-Underwriting DSCR Calculations

Know where you stand before you apply

Identify Negotiable Levers

Prepay period

Rate buydown

Reserve contributions

Model Scenarios

Test what happens at 0.9, 1.0, and 1.1 DSCR levels

Match your LTV expectations to what’s achievable

Present a Strong Case

Don’t just apply—structure

Show how your adjustments improve cash flow and reduce lender risk

Why This Matters for Rental Property Owners

If you’re planning a cash-out refinance, even small shortfalls in DSCR can jeopardize your plans. But by understanding your numbers and working with a lender-savvy broker, you can often:

✅ Secure higher LTV

✅ Improve rate and cash flow

✅ Avoid surprises at underwriting

✅ Scale your portfolio faster

Recap: The Smart Fix for a 0.93 DSCR

Original DSCR came in at 0.93:1

Lender required 1.0:1 minimum

We improved cash flow by lowering the rate

Got to 1.0:1, kept 75% LTV

Client saved money and unlocked more equity

Want Help Structuring Your DSCR Refinance?

At Mortgage To Invest, we help you get creative, stay compliant, and win better terms on every deal.

📞 Call us at (619) 586-9597

🌐 Visit www.MortgageToInvest.com

📧 Email [email protected]

🗓️ Or Schedule a Funding Strategy Call today

Let’s make your next investment property refinance your best one yet.